Wirex Visa Card Review

Wirex is one of the longest-running crypto debit card options in existence.

The company behind the Wirex Mastercard card was founded all the way back in 2014. Wirex has continued to offer their service throughout multiple booms and busts in the crypto market and now offers the Wirex Visa in the USA.

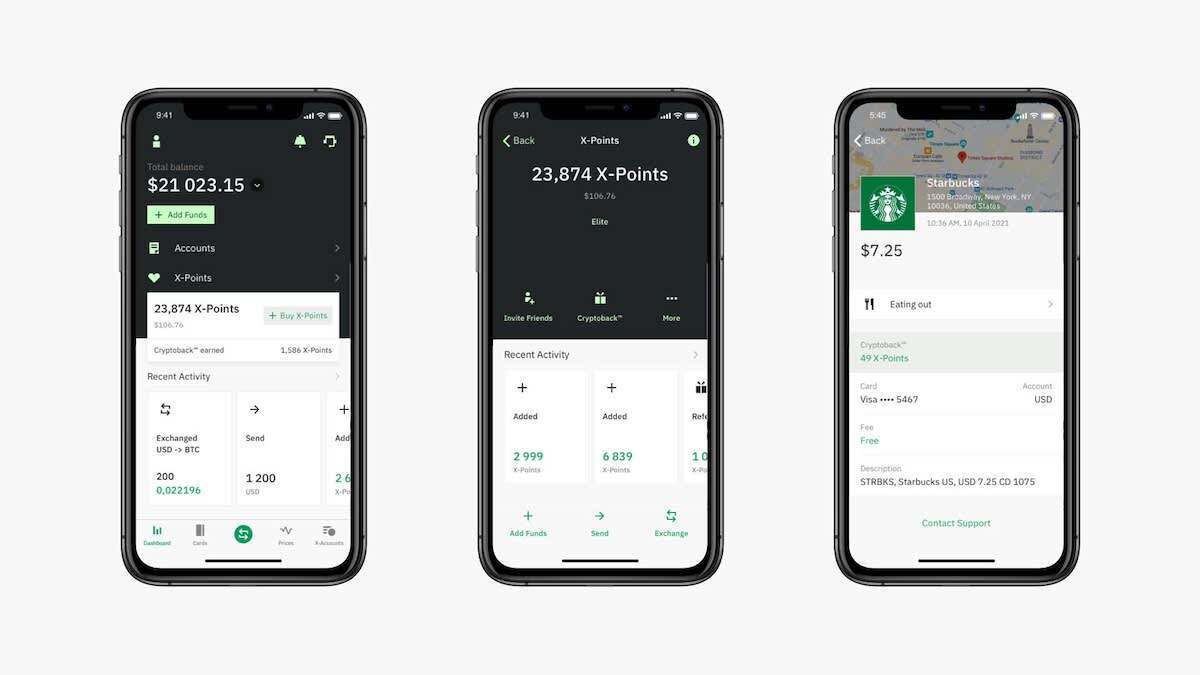

Like many other crypto debit cards these days, the Wirex Visa card has a proprietary token attached to it in the form of X-points, which can be converted to cryptocurrencies. You can earn up to 8% in cryptoback with X-Points although you don’t get quite as many perks as other token-powered crypto debit cards such as the Crypto.com Visa card and the Swipe Visa card.

Find out of the Wirex Visa card might be a good choice for you in our review below.

Wirex is a crypto-friendly currency account. It allows you to store, transfer, and exchange between cryptocurrencies (e.g., Bitcoin) and fiat currencies (i.e., GBP, EUR, & USD).

You can also shop in-store and online with Wirex’s GBP Mastercard debit card

Is it the best bitcoin debit card available in the UK and EU? Check out this Wirex review to see what I think.

Pros & Cons

Pros

Earn up to 8% cashback rewards for all in-store purchases

Instant top-ups if you link your debit/credit card

Crypto funds held in cold storage using multisignature addresses

Prepaid cash is held in FDIC-insured accounts

Commission-free trading and zero ATM fees (up to $250)

Cons

Less perks than some of the competing crypto credit cards

The card varies in different countries

You must convert X-Points to receive cryptocurrencies

High fees for exchanging between crypto and fiat

What is the Wirex Visa Card?

The Wirex Visa card is part of the greater Wirex application, which is targeted to people who often find themselves in different parts of the world and needing to access a variety of different currencies.

Users are able to exchange currencies within the Wirex app, and they can move funds to their card account when they want to be able to access those funds through the Wirex Visa card. This crypto debit card comes with a cashback rewards program that can reach as high as 8%; however, the rewards are paid out in Wirex’s proprietary X-Points token, which must be converted to crypto.

What Are the Benefits of the Wirex Visa Card?

The biggest benefit available to Wirex Visa card users is the potential for 8% cryptoback rewards. However, these rewards are handed out in the form of X-Points.

If you’re looking to earn actual cryptocurrency than you’ll have to convert your X-Points into cryptos like Bitcoin or Ethereum. You can also take advantage of Wirex’s recently updated “X-Tras” rewards program by amassing X-Points.

Wirex also has plans to launch sDeFi-powered interest-earning accounts in the near future, which will be branded as X-Accounts. The company offers a wide selection of different cryptocurrencies, which is a nice change from certain cards like BlockFi Visa, which only offers Bitcoin rewards.

Potential Wirex Visa Card Dealbreakers

One of the downsides of the Wirex Visa Card is that users receive X-Points instead of cryptocurrency, which adds an extra step for actually getting crypto.

Another downside of the Wirex Visa Card is that the rewards program doesn’t currently offer near as many perks as the Crypto.com Visa Card or the Swipe Visa Card. The CRO card, in particular, offers perks like free Netflix and Spotify if you hold enough of the proprietary Cronos token.

Finally Wirex is a massive globe-spanning company with different products in different jurisdictions. This creates confusion as it used to offer a Mastercard in certain countries but now offers a Visa card in the USA. In the rest of the world, Wirex also offers the WXT token while in the USA it’s all about X-Points. That makes Wirex one of the more confusing crypto credit cards.

Is Wirex Card Safe?

Yes. The Wirex Visa Card is issued by Sutton Bank and even offers up to $250,000 in FDIC insurance on prepaid card funds.

The company also offers a secure wallet in the form of the Wirex Wallet and X-Account.

What Are Wirex Card Fees?

Wirex offers a few different levels of memberships but fees are minor on all of them.

Here’s a look at the fees (or lack thereof) on Wirex:

- $0 annual fees

- Commission-free trading

- Unlimited cryptocurrency external withdrawals

- Free ATM withdrawals up to $250 (2% after)

- No account fee

- 1% fee on crypto top-ups

Is the Wirex Visa Card Right for Me?

It’s hard to say for sure as no card is perfect for everyone.

The Wirex Visa card has a relatively simple rewards structure where you can earn up to 8% back in crypto rewards. Converting from X-Points is annoying but you do get to choose between 37 different cryptocurrencies, which is a very nice selection. There are no annual fees and even ATM fees are covered up to $250 a month. It also offers instant top-ups for a relatively seamless experience.

The card is definitely not right for anyone in New York as its currently not available in that state.

Payment Methods

Inside the UK

UK residents can top-up a Wirex account by adding GBP with a debit card or making a UK bank transfer (via Faster Payments).

Outside the UK

In the EU, you can add money to your Wirex account with a debit card or by making a SEPA bank transfer. SEPA Instant is also supported.

Check out this help article for some relevant fees/limits.

Fees

Wirex Card Fees

Setting up a Wirex account is FREE and getting a physical card issued and delivered is also FREE. There are also no domestic transaction fees and no loading fees. In a recent update, Wirex also removed the monthly account management fees that you used to be charged.

However, you’ll need to pay up to £29.99 per month to unlock the highest cashback and savings rates. If you stick with a free account, then you’ll be limited to just 0.5% cashback (in-store only).

These are the other Wirex card fees and limits and fees that I picked out:

| Fee or Limit | Charges (UK) | Charges (EEA) |

|---|---|---|

| ATM charge (Domestic & International) | FREE for up to €400 per month. (2% fee on anything above this) | FREE for up to €400 per month. (2% fee on anything above this) |

| ATM withdrawal limit (Daily) | €250 | €500 |

| ATM withdrawal limit (Monthly) | €2,000 | €5,000 |

| Spending limit (Daily) | €1,500 | €20,000 |

| Spending limit (Monthly) | €7,500 | €20,000 |

| Credit & debit card top-up | €1,300 per day | €2,500 per day |

| Maximum account balance | UNLIMITED | UNLIMITED |

Wirex Token (WXT)

Wirex Token (WXT) is a utility token issued by Wirex.

It’s not required whatsoever, but you can upgrade your Wirex account using Wirex Token (WXT) to unlock higher cashback rates.

| Amount | Standard | Premium | Elite |

|---|---|---|---|

| Monthly Cost (Approx) | £0 | £9.99 | £29.99 |

| Cashback Amount | 0.5% | 1% | 2% |

| In-Store Cashback | Yes | Yes | Yes |

| Online Cashback | No | Yes | Yes |

This cashback is paid out in Wirex Token (WXT), but the amount of cashback you’re able to get is limited (depending on whether you have a Standard, Premium, or Elite account).

| Standard | Premium | Elite | |

|---|---|---|---|

| Max Cashback (Per Month) | 10,000 WXT | 50,000 WXT | 150,000 WXT |

| Max Cashback (Per Transaction) | 1,000 WXT | 5,000 WXT | 15,000 WXT |

At the time of writing, this means you can earn up to about £30 in cashback per month if you’re on a Standard account. That means you’d stop getting cashback if you spent more than around £6000 in a month (in-store) using the Wirex card on a Standard account.