SushiSwap Review

What is SushiSwap ?

SushiSwap is a decentralized cryptocurrency exchange (DEX) built on the Ethereum blockchain. It was launched in September 2020 as a fork of Uniswap, another popular DEX.

SushiSwap operates on an automated market maker (AMM) model, which allows users to trade cryptocurrencies without the need for intermediaries like traditional exchanges. Instead, users can trade their tokens by interacting directly with liquidity pools, which are smart contracts that automatically execute trades based on predefined rules. These liquidity pools are filled with users’ funds, which they contribute to the pool in exchange for rewards.

One of the key features of SushiSwap is its governance token, SUSHI. Holders of SUSHI have the ability to vote on proposals related to the development and management of the SushiSwap platform, such as changes to fees or the addition of new tokens.

SushiSwap also offers users the ability to earn rewards through a process known as yield farming, where users can provide liquidity to pools and earn a portion of the trading fees generated by the pool.

Overall, SushiSwap aims to provide a more decentralized, community-driven alternative to traditional cryptocurrency exchanges, allowing users to trade cryptocurrencies in a more transparent and democratic manner, while also earning rewards for participating in the platform’s growth and development.

Who Are the Founders of SushiSwap ?

SushiSwap was founded by an anonymous developer or group of developers who go by the pseudonym “Chef Nomi.” The identity of Chef Nomi is unknown, and they have not publicly revealed their real name or any personal details.

Chef Nomi was originally a community member and liquidity provider on Uniswap, another decentralized exchange built on the Ethereum blockchain. In August 2020, Chef Nomi proposed the idea of creating a fork of Uniswap that would redistribute a portion of the platform’s fees to liquidity providers, rather than simply burning them.

This idea gained traction within the cryptocurrency community, and Chef Nomi began working on the development of SushiSwap. The platform was launched on September 9, 2020, and quickly gained a following, with many users drawn to its unique features, such as the ability to earn rewards through yield farming and the governance token SUSHI.

However, shortly after the launch, Chef Nomi sparked controversy by selling a large portion of their personal SUSHI holdings for Ethereum, which caused the price of SUSHI to drop significantly. This led to accusations of an exit scam, and Chef Nomi eventually transferred control of the project to Sam Bankman-Fried, the CEO of cryptocurrency exchange FTX. Since then, SushiSwap has continued to operate as a community-driven project, with a team of developers and community members working together to further develop and improve the platform.

SushiSwap Fees

Trading Fees

Users incur a 0.3% fee when they trade on the exchange. This fee is charged directly by SushiSwap, and the Ethereum gas fees are charged separately from the Ethereum wallet used to interact with the platform.

Withdrawal fees

Currently, SushiSwap does not directly charge any withdrawal fees. As the tokens are held in the users Ethereum wallet, gas fees would be charged if the user wanted to send the funds to an external wallet.

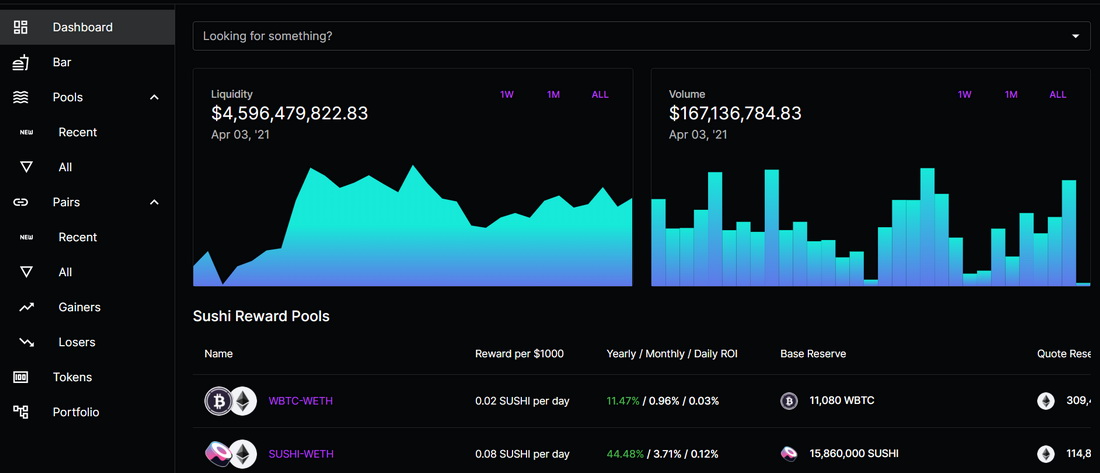

Trading View

On the main SushiSwap analytics page, there is a comprehensive overview of key information regarding the exchange. Users can view statistics and price graphs of the total liquidity and volume within a specified range, as well as the reward pools below.

To the left of this page is an options menu, allowing users to view token pairs, top coin gainers/losers, pools, portfolio, and more.

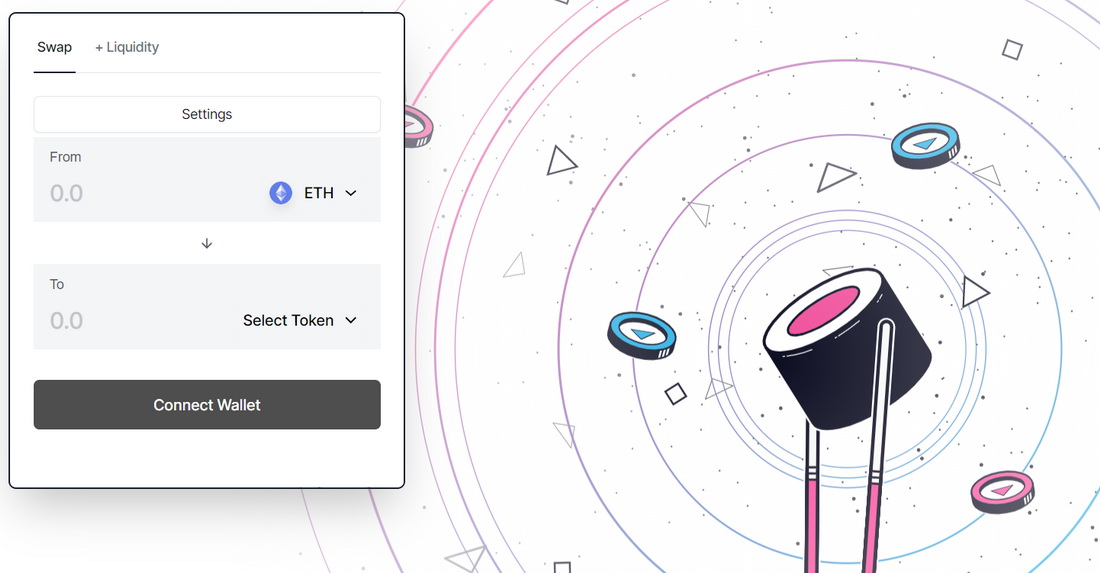

Swap

The interface is designed to be as easy to use as possible. The easy to navigate sidebar on the left, coupled with the intricate and beautiful design of the page, make it appealing and fun to use. As seen in the below image, you can either swap tokens directly or add to liquidity pools.

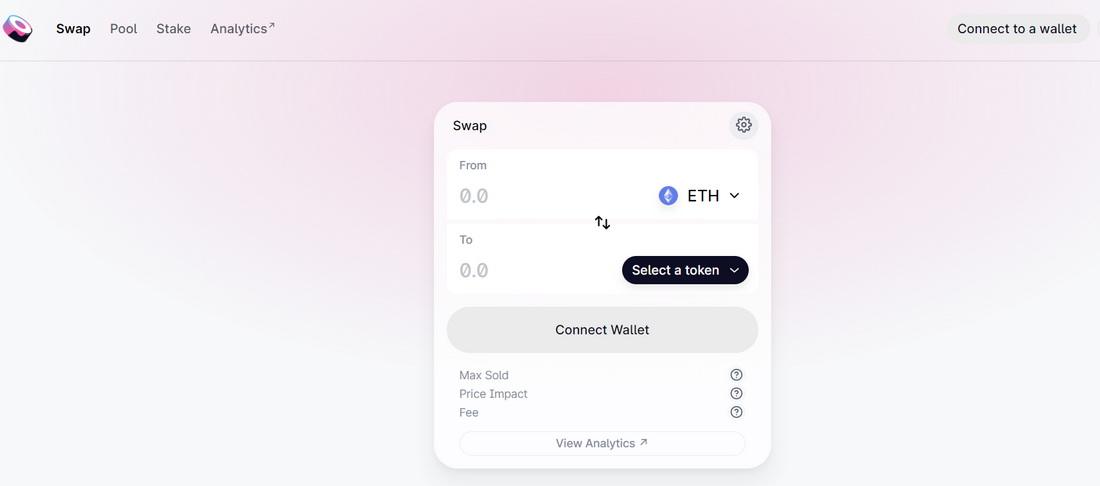

There is another trading view that looks nearly identical to Uniswap. As seen below, you have the ability to swap tokens and select between adding liquidity to pools or staking on the upper right.

Yield Farming and Liquidity Pools

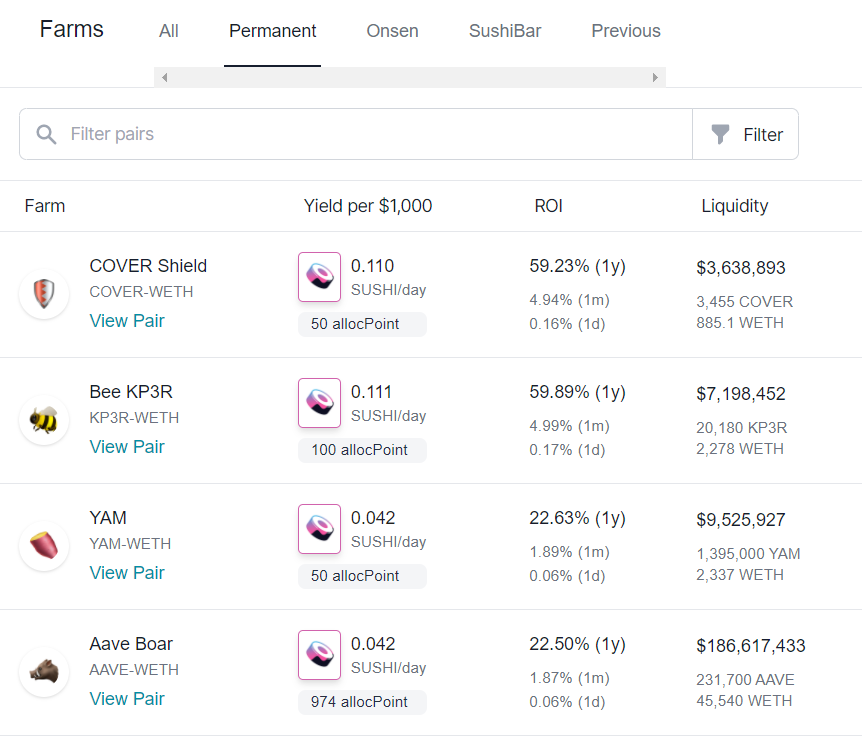

Yield Farming

The exchange has a large variety of farms/liquidity pools to choose from. Below is an example of some farms with information such as the yield per $1000, ROI, and total liquidity:

Users can earn rewards from farming based on each new block from staking the SLP tokens. 2/3 of the rewards are vested for 6 months right from when they’re earned, so you will have more SUSHI available to you every 6 months that passes.

You can also select from a variety of different types of farms, such as permanent, Onsen, and the SushiBar for more options. Many of these farms have lucrative ROIs and incentives, but always do your due diligence before farming. Onsen pools, for example, contain new/upcoming and established projects to choose from.

Liquidity Pools

For liquidity pools, if you become a liquidity provider, you receive SLP (Sushiswap Liquidity Provider tokens), which represent a proportional share of the assets in the pool. This ensures that a user has the flexibility to withdraw their funds whenever they need to.

As a liquidity provider, you will earn rewards of 0.25% derived from a fee on all trades proportional to your share of the liquidity pool.

SushiSwap has also designed a creative way to increase liquidity for new tokens on their platform – this initiative is called the “Menu of the Week.” Around 7 days are allotted for users to stake SLP tokens for up to 10 new pools, and in return they are given very high yields as a reward.

The submissions for the menu are discussed on forums by the community, where people offer suggestions and then cast a vote for the top tokens of choice to be added.

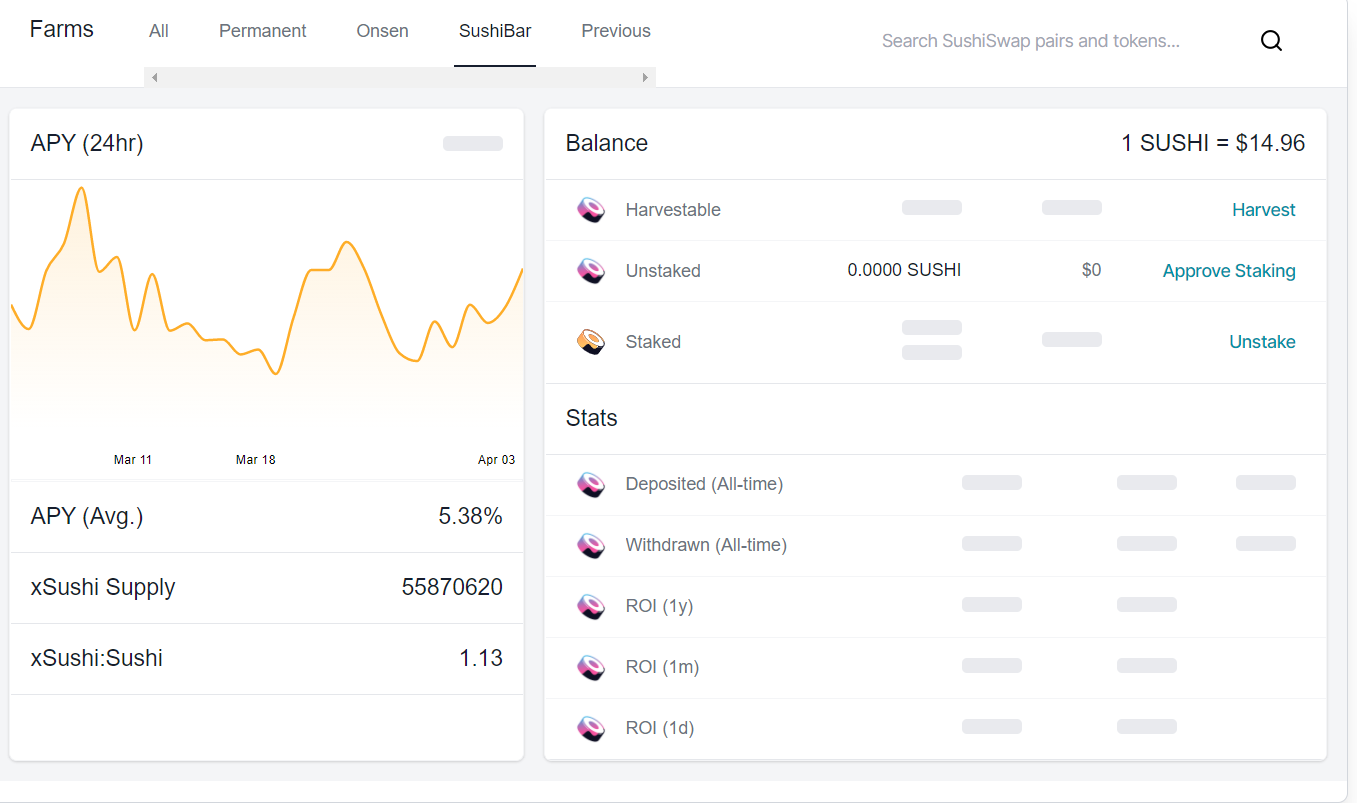

SushiBar Staking (xSushi APY)

The SushiBar is where you can stake your SUSHI tokens in return for interest on your funds – the SUSHI tokens are staked for xSUSHI. The interface is below, displaying all of your statistics, APY information, and more.

SushiSwap Lite also offers you the opportunity to stake your SUSHI tokens and earn recurring income, in a much simpler manner. The xSUSHI tokens automatically earn fees of 0.05% of all swaps proportional to your total share of the SushiBar.

Supported Countries and Cryptos

Given the anonymity of the founders, it remains unknown where exactly SushiSwap was created. There are rumors that Chef Nomi resides somewhere in Asia, and 0xMaki could be in a French-speaking territory or country given his French accent. So, it is possible that it could have been created in any of these regions.

In regards to supported countries, users need not worry. SushiSwap is available to anyone with an internet connection and Ethereum wallet, as it is completely decentralized.

SushiSwap currently offers over 100 different ERC-20 token trading pairs on its platform, so there are plenty of options to select from when swapping or providing liquidity.

SUSHI Token

SUSHI is the native governance token of the SushiSwap decentralized cryptocurrency exchange (DEX), built on the Ethereum blockchain. The token was created as part of the platform’s launch in September 2020 and has since become an integral part of the SushiSwap ecosystem.

As a governance token, SUSHI holders have the ability to vote on proposals related to the development and management of the SushiSwap platform. This includes decisions such as changes to fees or the addition of new tokens to the platform. Each SUSHI token represents a vote, and the more tokens a user holds, the greater their voting power.

In addition to its governance functionality, SUSHI is also used as an incentive for liquidity providers and users who participate in the platform’s various pools and staking programs. For example, users who provide liquidity to SushiSwap’s liquidity pools can earn SUSHI tokens as a reward, proportional to their contribution.

The total supply of SUSHI is capped at 250 million tokens, with a significant portion of the supply allocated to community incentives and development funding. The token has been listed on a variety of major cryptocurrency exchanges, including Binance, Coinbase, and Huobi, and has seen significant trading volume and market capitalization since its launch.

SUSHI is available for purchase on SushiSwap, as well as many other major exchanges such as Binance and Coinbase.

Deposit and Withdrawal Methods

Depositing assets on the protocol can only be done through an Ethereum wallet – once you’ve connected your wallet, you can either trade, stake, or deposit your assets into a pool.

Withdrawing is done in a similar manner. If your tokens are staked or within a liquidity pool, you will need to withdraw them from the exchange back into your Ethereum wallet.

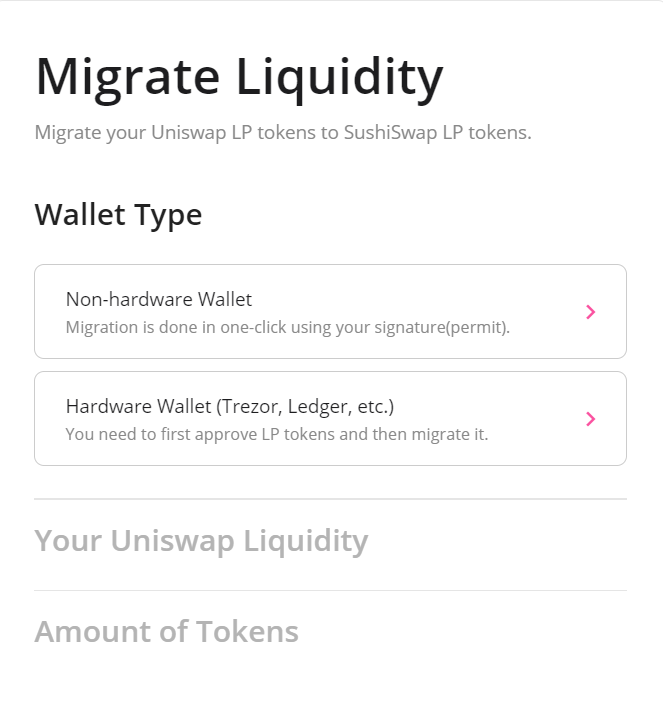

Migrating Uniswap v2 LP tokens

SushiSwap offers you the ability to easily transfer your liquidity from Uniswap to its platform within seconds. This is a nice feature if you’re looking to leverage the offerings on SushiSwap without having to go through the hassle of sending funds and utilizing addresses to do so. The SushiSwap Lite platform will allow you to migrate liquidity, as seen below.

Lending (BentoBox)

BentoBox is SushiSwap’s version of an advanced isolated pair lending solution. It aims to solve some of the issues associated with other popular lending platforms, such as Compound and Aave. BentoBox provides feature such as isolated lending pairs, flexible on and off-chain oracles, liquid interest rates, contracts created to work with low gas fees, and the ability for flash loans.

Limit Orders

SushiSwap sets itself apart from its competition even further by offering limit orders, a feature not often found on other AMMs. Limit orders are decentralized and contain both Orderbook and Settlement contracts in order to be implemented.

The OrderBook contract contains a record of the limit orders that users have requested.The Settlement contract actually swaps the tokens for the requested orders. Relayers then fill an order so they can meet the minimum price requirement based on the order. Once the order goes through, a 0.2% fee is provided to the relayer and xSUSHI holders as a reward.

How to use SushiSwap Exchange

To use SushiSwap, you will need to have an Ethereum wallet and some Ether (ETH) or other ERC-20 tokens to trade. Here are the steps to use SushiSwap:

Connect your Ethereum wallet: SushiSwap supports a variety of wallets, including MetaMask, WalletConnect, and Coinbase Wallet. Choose your preferred wallet and connect it to the SushiSwap platform.

Navigate to the trading page: Once your wallet is connected, you can navigate to the SushiSwap trading page, which displays a list of available trading pairs.

Select a trading pair: Choose the trading pair you want to trade. For example, if you want to trade Ether (ETH) for SUSHI, you would select the ETH/SUSHI trading pair.

Input your trade details: Enter the amount of tokens you want to trade and specify whether you want to buy or sell. SushiSwap uses an automated market maker (AMM) model, so the platform will automatically calculate the exchange rate based on the current liquidity of the trading pair.

Confirm the trade: Review the details of your trade and confirm the transaction. You will be prompted to approve the transaction in your wallet, and once approved, the trade will be executed.

Add liquidity or stake tokens: SushiSwap also allows users to earn rewards by adding liquidity to its liquidity pools or staking tokens in its various pools. To do this, navigate to the “Pool” or “Farm” sections of the platform and follow the instructions to contribute your tokens to the relevant pool.

Overall, SushiSwap aims to provide a user-friendly and accessible way for users to trade and earn rewards through its decentralized exchange and liquidity pools. However, as with any cryptocurrency exchange, it is important to exercise caution and do your own research before investing your funds.

Security

Although SushiSwap operates well and is considered generally safe, there are a few security concerns to be aware of. In September 2020, Quantstamp conducted a security audit of the exchange and found a few issues.

Some of these concerns included errors allowing the same liquidity provider token being added multiple times, an issue allowing funds to be stolen from the platform if the owner’s private key was discovered, and a problem that could deplete the gas from its massUpdatePools.

Quantstamp noted that none of these issues or vulnerabilities were grave enough to redeploy the existing contacts, but advised users to stay cautious in general.

In September 2020, Chef Nomi sold all of his SUSHI tokens (worth around $6 million at the time) within 10 days of the project launched. There was tremendous backlash from the community, questioning the founders’ integrity and the security of the SushiSwap platform, considering the SUSHI token dumped rapidly after the sale.

Conclusion

SushiSwap has had a very interesting history, but has come a long way in regards to establishing itself as a true contender in the DeFi space. As of today, it’s an ERC-20 powerhouse that continues to innovate and provide great benefits to its users. Below we will explore the advantages and disadvantages of using the platform:

Pros

- Over 100 ERC-20 trading pairs

- Fun, sushi-based initiatives for swapping, farming, liquidity pools, etc.

- Easy-to-use platform, with a color and aesthetically pleasing design

Cons

- High gas fees (although this is an issue across all Ethereum-based AMMs)

- Can be somewhat complex for a new DeFi user

- Slight security concerns, although nothing too alarming