Poloniex Review

Poloniex is a cryptocurrency exchange that combines low trading fees with a list of over 350 supported cryptocurrencies. Additionally, we like that Poloniex is a decentralized exchange, and offers margin trading, lending, and other crypto products. With its low fees, a wide selection of assets, and useful features, this exchange could potentially meet all needs of many crypto traders. However, it’s not available to U.S. users.

Self-proclaimed “legendary crypto assets exchange,” Poloniex is not as popular as it just to be anymore, but it still offers quality service when it comes to trading bitcoin and altcoins. It offers the lowest fees in the industry and only asks only for your email during registration as identity verification is 100% optional. However, it lags behind other exchanges in terms of customer service and has experienced a security breach back in 2014. After changing owners 2019, the exchange has relocated to Seychelles and adopted a more open, loosely regulated approach, which allows it to offer a wider array of services, support more cryptocurrencies, and gradually get back towards being an important part of cryptoverse’s infrastructure.

Poloniex Review: Key Features

Poloniex is a centralized cryptocurrency exchange for both experienced and amateur cryptocurrency traders. It offers a range of crypto markets, advanced trade types, as well as margin trading and crypto lending, which makes it a convenient place for traders from all walks of life.

Poloniex exchange homepage. Source: Poloniex.com

The key features of the exchange include:

- Trade 60+ cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP),Tron (TRX), Eos (EOS), Monero (XMR), and many more.

- Low fees. Poloniex has the lowest trading fees amongst popular altcoin exchanges.

- Margin trading. Aside from spot trading, you can also conduct low fee margin trades with up to 2.5x leverage.

- Poloniex margin lending. You can earn passive income by lending your crypto assets with interest.

- Poloni DEX and IEO launchpad. Invest in the hottest new crypto projects, and make use of Poloniex’s decentralized counterpart Poloni DEX.

- Sign up and trade within minutes. Poloniex does not force you to pass KYC (know your customer) checks, so you can sign up with your email and start trading immediately. If you don’t have any cryptocurrency yet, you can buy some with fiat using its Simplex integration, though this operation will require you to verify your identity.

In 2021, Poloniex does not support fiat trades and deposits, and its customer support efforts are still minute. However, after it’s relocation toSeychelles, the crypto exchange underwent a series of changes and is one of the best altcoin exchanges today in terms of the platform’s usability, fees, and performance.

Source: Poloniex.com

In this Poloniex review, we’ll look into the exchange’s current situation, trading fees, services, ease of use, and accessibility.

Poloniex History and Background

Launched in Delaware, USA, Poloniex began in January 2014. Its founder is Tristan D’Agosta, who has a background in music and previously established the Polonius Sheet Music company in 2010.

Right after the launch, Poloniex suffered a high-profile hack in March 2014 when it lost about 12% of its BTC, which was worth approximately USD 50,000 at the time. Nevertheless, the exchange’s management responded to the hack openly and by offering full reimbursements for the stolen 97 bitcoins out of D’Agosta’s company profits.

After a shaky start, Poloniex had to temporarily increase its fees and made the headlines again in 2016 as the first exchange to list Ethereum (ETH) cryptocurrency. After that, the exchange’s trading volume began to increase, and it became one of the more popular exchanges in terms of liquidity.

Source: Poloniex.com

In early 2018 Poloniex was acquired by payments company Circle, which reportedly aimed to transform it into America’s first fully regulated crypto exchange. The company paid USD 400,000 for the acquisition.

In order to become regulatory compliant, the exchange delisted almost 50% of its crypto assets that are at risk of being classified as securities and implemented strict KYC (know your customer) checks.

Another customer pain-point was Poloniex’s customer support, which was as dull as ditchwater and had over 140,000 outstanding customer support tickets. It’s been reported that some customers have been waiting for several months before they heard back from the exchange. Such poor customer service had led to a loss of thousands of Poloniex users.

2019 was another big year of changes for Poloniex exchange. Early in the year, the exchange faced challenges posed by the uncertainty in the U.S. cryptocurrency regulatory environment. As a result, it continued reducing the list of available coins for the U.S. crypto investors. In the summer, Circle-owned exchange bumped into another hurdle due to the cryptocurrency CLAM crash as many investors experienced unexpected losses.

In November 2019, Circle spun out Poloniex into a separate entity, Polo Digital Assets, Ltd., backed by an unnamed group of Asian investors, which includes TRON’s CEO Justin Sun. The newly formed company was registered in Seychelles – a remote island in the Pacific known for crypto favorable regulations. It is also a home for other unregulated cryptocurrency exchanges like BitMEX and reportedly even Binance. Commenting on this move, Circle said that it faced “challenges as a US company growing a competitive international exchange.”

Under new leadership, the Poloniex crypto exchange took another direction and dropped forced AML/KYC checks, so from now on, it is possible to trade on Poloniex without verification again. Besides, the platform added new features revoked trading access for the United States customers, meaning that it completely abandoned the idea to become a fully regulated exchange.

In December 2019, Justin Sun led exchange made it to the spotlight once again. This time, it attracted controversial sentiment due to the delisting of DigiByte (DGB), a somewhat popular altcoin, after Justin Sun and DigiByte’s founder Jared Tate got into a skirmish on Twitter.

In 2021, Poloniex remains a popular digital currency exchange with some of the lowest trading and withdrawal fees on the market. In February, the exchange experienced some issues with its order book and had to delete 12 minutes of trading history due to a bug. In April, the exchange revamped its interface across its website and mobile apps and promised more significant improvements later in the year.

Poloniex supported countries

Currently, Poloniex is a global exchange with only a few geographic restrictions. The access to the Poloniex platform is prohibited for the residents and citizens of the following countries:

- Cuba

- Iran

- North Korea

- Sudan

- Syria

- The United States

Users from other countries can access and trade on Poloniex without restrictions.

To access the platform, you only need to provide your email, since identity verification is optional.

Poloniex verification. Source: Poloniex.com

Poloniex verification tiers

Poloniex cryptocurrency exchange offers two account verification levels: Level 1 and Level 2.

- Level 1: You obtain level one verification by default once you sign up on Poloniex. It allows for unlimited spot trading, deposits, impose an up to USD 20,000 daily withdrawal limit, and all other Poloniex services. You won’t be able to access Poloniex margin trading and IEO LaunchBase though and may experience issues with account recovery.

- Level 2: Access all Poloniex features, including up to USD 750,000 per day.

For level 1 verification, you only need to register on the exchange using a valid email address.For level 2, you will need to submit the following information and documents:

- Your residential address

- Your phone number

- Your date of birth

- Your ID, driver’s license, or identity card

- Proof of address

Here is a quick video on how to start trading on the Poloniex exchange using a tier 1 Poloniex account.

In addition to Level 1 and Level 2 accounts, large-volume traders, professionals, and institutions can apply for opening Poloniex Plus Silver, Gold, or Market Maker accounts.

Poloniex Plus services come with numerous benefits, including lower trading fees, premium features, account managers, whitelisting priority, increased withdrawal limits, and much more.

Differences between Poloniex Plus Silver and Gold accounts. Source: Poloniex.com

You can learn more about Poloniex Plus programs on the Poloniex support page or by contacting the exchange directly.

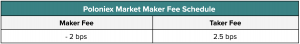

Speaking of Poloniex Market Maker Program, it was made to incentivize top liquidity providers to join the exchange. It offers them a rebate of 0.02% per executed maker order.

Poloniex Market Maker Fee Schedule. Source: Poloniex.com

To be eligible for the Poloniex Market Maker program, you must have a 30-day trading volume of a minimum of USD 10,000,000 and have at least 12 trading pair points per month.

Source: Poloniex.com

Each market maker’s performance is evaluated on a monthly basis. Learn more about how it all works here.

Poloniex Fees

When it comes to trading, Poloniex fees are amongst the lowest in the industry. Poloniex charges its users for placing spot and margin trades, as well as cryptocurrency withdrawals.

The Poloniex trading fee schedule is rather straightforward. The fee you pay per trade depends on whether you’re on the taker or maker side of the deal, as well as your 30-day trading volume. VIP customers that fall into Poloniex Plus Silver, Gold, or market maker tiers pay 0% for maker trades and less than 0.04% for executed taker orders.

| Maker Fee | Taker Fee | 30-day Trade Volume |

|---|---|---|

| 0.090% | 0.090% | Less than USD 50,000 |

| 0.075% | 0.075% | USD 50,000 – 1,000,000 |

| 0.040% | 0.070% | USD 1,000,000 – 10,000,000 |

| 0.020% | 0.065% | USD 10,000,000 – 50,000,000 |

| 0.000% | 0.060% | More than USD 50,000,000 |

| 0.000% | 0.040% | Poloniex Plus Silver |

| 0.000% | 0.030% | Poloniex Plus Gold |

| -0.020% | 0.025% | Poloniex Market Maker |

For the sake of comparison, Kraken offers a maker fee of 0.16% and 0.26% taker fee for low volume retail traders, while the most popular altcoin exchange Binance offers a0.1% base rate per trade for every low volume investor. Other popular altcoin exchanges, such as Coinbase , Bitfinex, or Crypto.com also charge much more per trade when comparing the most basic account tiers.

| Exchange | Maker fee | Taker fee | Visit Exchange |

|---|---|---|---|

| Poloniex | 0.09% | 0.09% | Visit |

| Crypto.com | 0.0728% | 0.0728% | Visit |

| OKX | 0.08% | 0.1% | Visit |

| Binance | 0.1% | 0.1% | Visit |

| KuCoin | 0.020% | 0.060% | Visit |

| Bitfinex | 0.100% | 0.100% | Visit |

| Huobi | 0.2% | 0.2% | Visit |

| Gate.io | 0.15% | 0.15% | Visit |

| Coinbase | 0.60% | 0.40% | Visit |

| MEXC | 0.2% | 0.2% | Visit |

| CEX.io | 0.15% | 0.25% | Visit |

As such, Poloniex is the least costly option out there for users who seek to preserve their privacy.

The same fee schedule applies for Poloniex margin trading, as you will pay 0.09% per every executed margin trade (plus margin funding fees for traders who open leveraged positions).

Here’s how Poloniex ranks amongst other margin trading exchanges.

| Exchange | Leverage | Cryptocurrencies | Fees | Link |

|---|---|---|---|---|

| Poloniex | 100x | 40 | 0.1550% | Trade Now |

| KuCoin | 100x | 105 | 0.05% | Trade Now |

| OKX | 100x | 108 | 0.075% – 0.25% | Trade Now |

| Binance | 100x | 117 | 0.2% | Trade Now |

| Crypto | 20x | 53 | 0.2% | Trade Now |

| MEXC | 100x | 158 | 0.01 – 0.02% ++ | Trade Now |

| Gate.io | 100x | 83 | 0.075% | Trade Now |

| Bitfinex | 100x | 825 | 0.1% – 0.2% | Trade Now |

As for deposits and withdrawals, Poloniex doesn’t charge anyone for depositing cryptocurrency. Even though no fiat currency can be deposited, withdrawn, or purchased on the platform, you can still use fiat-pegged stablecoins in your trades. Customers will be charged for withdrawals, although these are set by the network of each cryptocurrency being traded.

For example, bitcoin withdrawals cost 0.0005 BTC, making Poloniex among the very cheapest of exchanges for processing withdrawals.

Here is a small sample with some of Poloniex withdrawal fees for some of the top cryptocurrencies.

| Coin | Withdrawal Fee |

|---|---|

| Bitcoin (BTC) | 0.0005 BTC |

| Dogecoin (DOGE) | 20 DOGE |

| Ethereum (ETH) | 0.01 ETH |

| Dash (DASH) | 0.01 DASH |

| Litecoin (LTC) | 0.001 LTC |

| Tether (USDT) | 10 USDT (OMNI) / 1 USDT (ETH) / 0 USDT (TRX) |

| Monero (XMR) | 0.0001 XMR |

| Ripple (XRP) | 0.05 XRP |

| Tron (TRX) | 0.01 TRX |

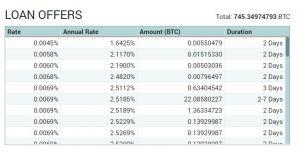

Last but not least, Poloniex has a margin lending and borrowing feature, which allows you to earn passive income from your crypto assets.

All margin borrowers pay interest to lenders based on the loaned amount. The lender typically specifies the interest rate; thus there are many different offers. As a lender, you will pay a 15% fee on earned interest paid by the borrower.

A small smaple Poloniex margin lending offers for BTC. Source: Poloniex.

In sum, Poloniex fees are very low, as it runs one of the least expensive crypto-to-crypto services in the industry.