Revolut Crypto Review

Beginner’s Guide

Introduction: Revolut is a popular digital banking app that also offers cryptocurrency trading. In this beginner’s guide, we will review Revolut’s cryptocurrency offering and walk you through the process of buying and selling cryptocurrency on the platform.

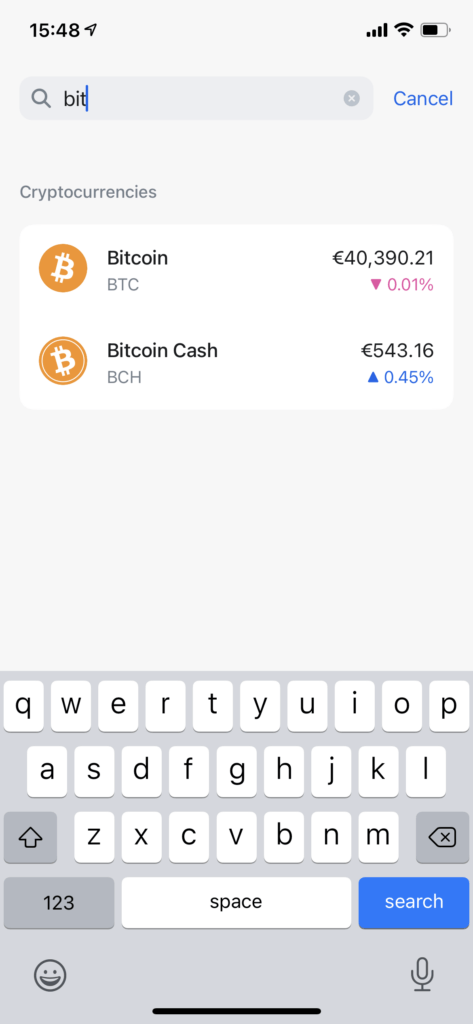

Revolut Crypto Review: Revolut offers a wide range of cryptocurrencies for trading, including Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and XRP. The platform is easy to use and provides real-time market data, allowing users to make informed decisions about their trades.

Revolut also offers a “Vaults” feature, which allows users to set aside funds in a separate account for their cryptocurrency investments. This feature can help users manage their investments and reduce the risk of accidentally spending their cryptocurrency.

One drawback of Revolut’s cryptocurrency offering is that users do not actually own the underlying cryptocurrency. Instead, Revolut holds the cryptocurrency on the user’s behalf. While this makes it easy to buy and sell cryptocurrency, it also means that users do not have control over their private keys and are not able to transfer their cryptocurrency to a personal wallet.

How to Buy Crypto with Revolut: To buy cryptocurrency on Revolut, follow these steps:

Step 1: Sign up for a Revolut account If you don’t already have a Revolut account, sign up for one on the company’s website or download the mobile app.

Step 2: Add funds to your Revolut account To buy cryptocurrency on Revolut, you will need to add funds to your account. You can do this by linking a debit card or bank account.

Step 3: Enable cryptocurrency trading In the Revolut app, go to the “Dashboard” and select “Cryptocurrencies.” From there, you can enable cryptocurrency trading.

Step 4: Buy cryptocurrency Once you have enabled cryptocurrency trading, you can buy cryptocurrency by selecting the “Buy” option and selecting the cryptocurrency you want to purchase. You can then enter the amount you want to spend and confirm the transaction.

Conclusion: Revolut offers a simple and easy-to-use platform for buying and selling cryptocurrency. While the platform does not provide users with full control over their private keys, it is a good option for those who want to easily invest in cryptocurrency without the hassle of setting up a personal wallet. As always, it’s important to do your own research and invest wisely.

Revolut is probably far from being the first name that you think of when you hear the term “cryptocurrency exchange”. However, this UK-based mobile banking solution has also entered the cryptocurrency industry, and although you might still struggle with finding a huge variety of user Revolut crypto reviews, some conclusions about this venture can already be drawn.

Being such an odd player in the crypto scene, as you can probably guess, Revolut brings a lot of very unprecedented features to the table. Reading into some of the things that users have to say about the platform, you’ll find terms like “CFD”, “derivatives”, “custodial”, and similar being thrown around.

Now, look – if you’re just starting out in the realm of crypto (or finance, in general), all of that can be confusing. However, I’m here to help you out – in the Revolut crypto review below, I will explain everything you need to know about this seemingly-uncanny crypto trading solution, and decrypt the terminology behind it.

If you prefer to use a real cryptocurrency exchange, though, Kucoin and Binance are going to be much better solutions.

Pros

- Extremely simple to use

- Supports the most popular crypto coins

- A fast-growing platform

- Many additional features

Cons

- You are not the holder of the cryptocurrency you’ve bought

- You can’t transfer your purchased crypto

- Very irrational fees

The complete guide to Revolut

Revolut is a digital bank that operates in Europe, America, and a handful of other countries.

It provides users with an IBAN bank account as well as access to traditional banking products in a few markets.

It also has a fully-fledged stock, commodities, and crypto trading platform.

Users can take advantage of it to get quick and easy exposure to the crypto world and stock markets.

Thanks to its easy user interface and detailed tutorials, Revolut is perfect for beginners.

The history of Revolut

Revolut was founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, with the goal of becoming a digital bank for the people.

Along the way, Revolut has shaken up the banking and financial sector, delivering a market leading product to its users.

There are now more than 15 million Revolut users around the globe and accounts come with fund protection up to €100,000.

It has also secured a valuation of $33 billion in 2021 thanks to successful funding rounds.

As time goes on, Revolut continues to improve its product and add new features that allow it to blow away traditional banks.

How to buy cryptocurrency at Revolut?

If you want to buy crypto, Revolut is one of the easiest places to do it.

You can buy crypto in seconds and it’s incredibly easy to manage from your Revolut account.

You also don’t have any of the other associated risks when you buy crypto at Revolut as it’s primarily a banking app.

This means that getting hacked and having your crypto stolen from Revolut is virtually impossible.

But, this also means that you’ll have to jump through some hoops before you can begin buying crypto at Revolut.

You will need to complete KYC before you can buy crypto at Revolut, as it’s a banking app.

So make sure you’ve got the following items to hand before you download the Revolut app:

- Passport/government issued ID

- Utility bill/credit card statement

- Employment contract

Bear in mind that this may be different depending on your region and your status in that region.

For example, if you’re British living in the USA, you’ll need to submit a copy of your visa.

Revolut currently does not have a website portal that you can use, so you will need to use the mobile application.

But it’s a sleek and smooth app that’s simple to use.

The reason for the additional documents is that Revolut is primarily a bank account, rather than a crypto exchange.

This means that you have to pass verification required for a bank account.

If you’re looking for a privacy focused exchange, Revolut is not for you.

Let’s learn how to create a Revolut account and start trading crypto!

Step-by-step guide to buy crypto at Revolut

When you’re ready to create your Revolut account, download the official app from the app store.

It works well on both iOS and Android, with all features being available on both apps.

You can deposit in a wide range of fiat currencies, so don’t worry if you’re not using the Euro.

Currently, you can deposit the following fiat currencies at Revolut:

- AED

- AUD

- BGN

- CAD

- CHF

- CZK

- DKK

- EUR

- GBP

- HKD

- HRK

- HUF

- ILS

- ISK

- JPY

- MAD

- MXN

- NOK

- NZD

- PLN

- QAR

- RON

- RSD

- RUB

- SAR

- SEK

- SGD

- THB

- TRY

- USD

- ZAR

As Revolut expands to more countries, you can expect this list to expand.

You can fund your account by using a debit card, bank transfer, Apple Pay or Google Pay.

Generally speaking, it takes around an hour to get your Revolut account fully verified.

But it can take less time during quieter periods of the day.

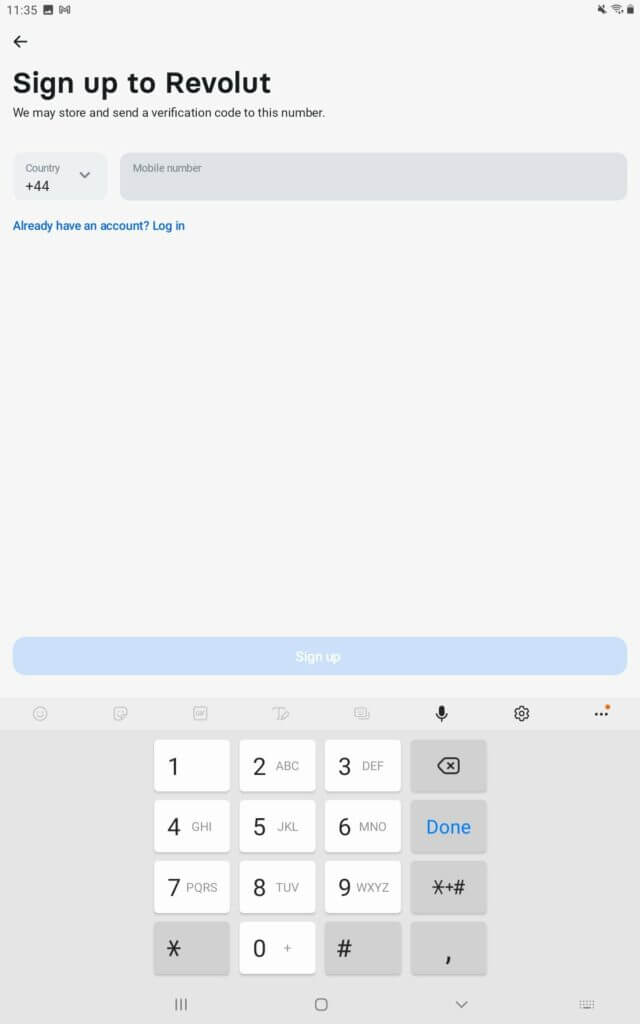

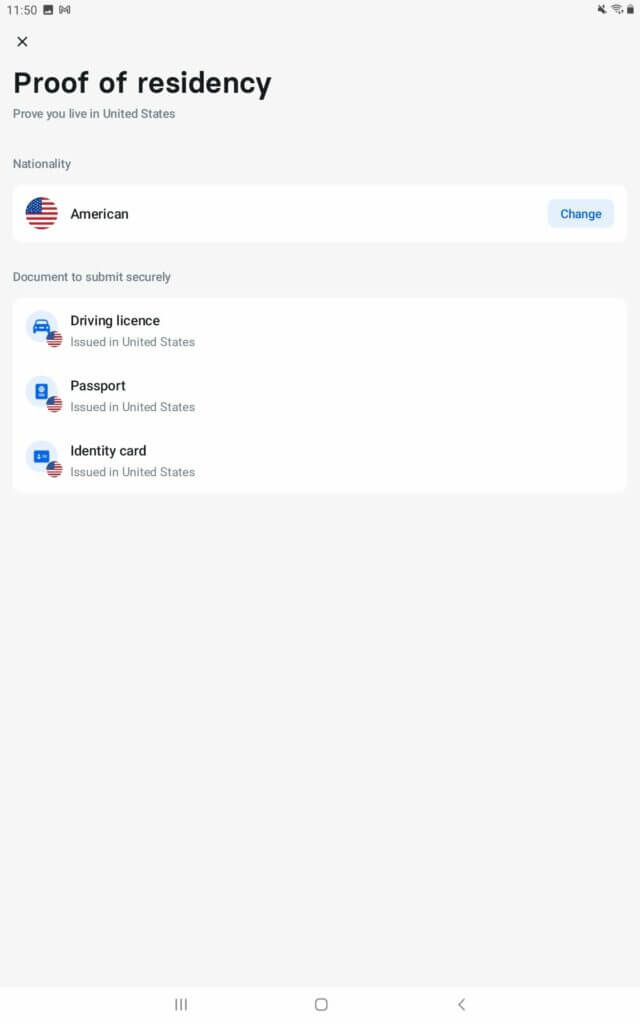

Step 1 – registration & verification

Let’s get you all set up and registered at Revolut.

The verification process is part of registration process, so make sure that you’ve got everything ready.

When you open the app for the first time, you’ll see an Instagram story style background.

You can tap to skip through the videos, or you can opt to watch them.

When you’re ready, hit sign up at the bottom of the screen.

You’ll then need to provide your phone number in order to get going.

Once you’ve put that in, input the 6-digit code that is sent to your number.

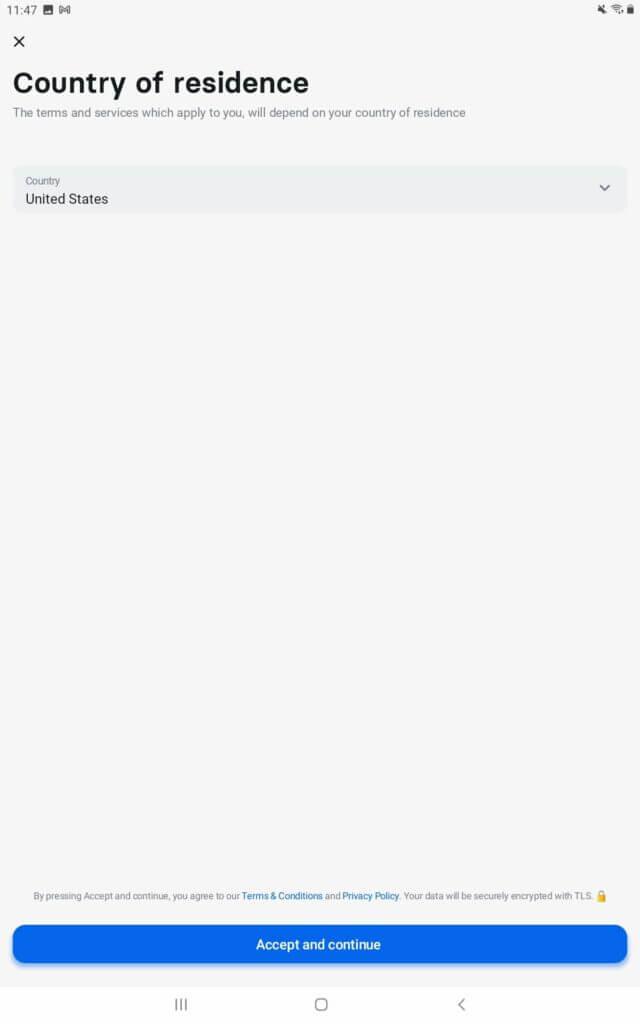

Next up, you need to select your country of residence.

Make sure that you’re honest here as it will only let you submit documents for that region.

After you’ve picked your country, start entering your address.

There is an auto fill feature which is pretty accurate.

If it can’t find your address, you can manually enter it.

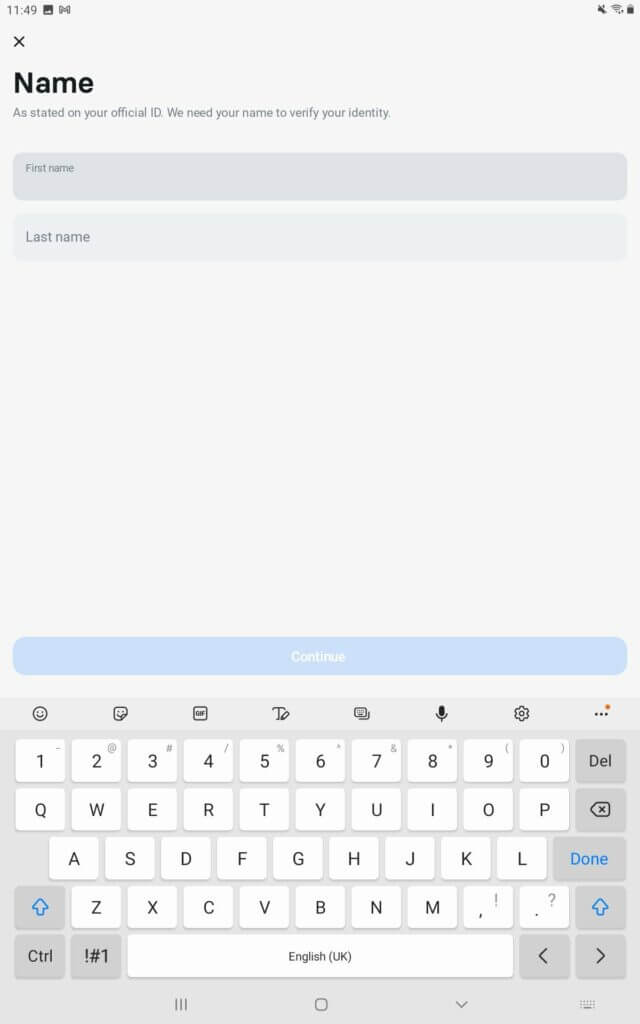

Then, input your name as it appears on your identity documents.

You then need to put in your email address and date of birth.

Get ready to start taking pictures and divulging your life story.

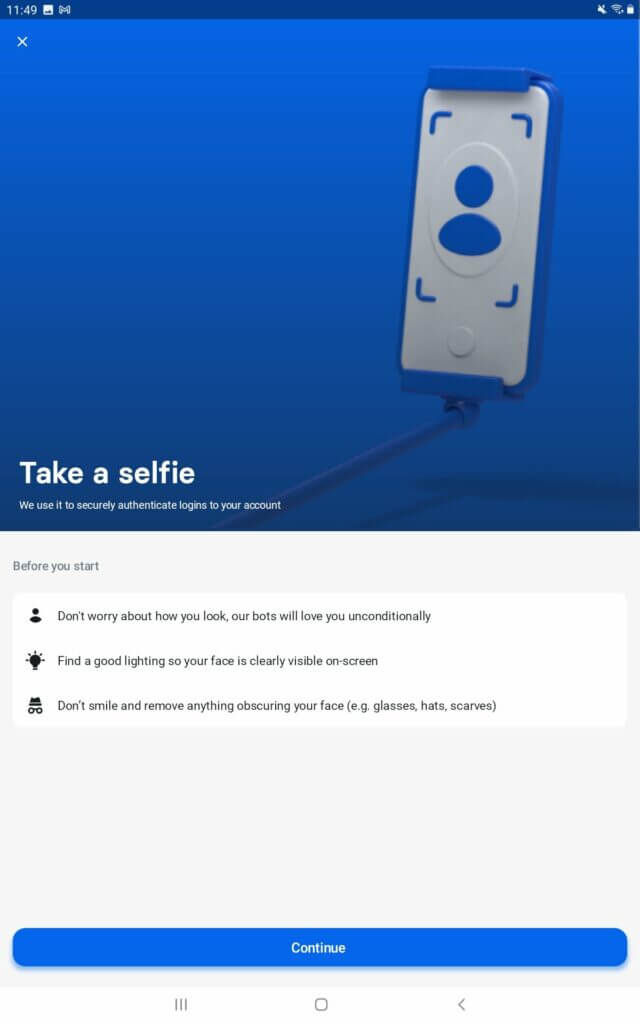

You’ll need to take a selfie, which needs to be clear.

This will be compared to the ID documents that you submit, so it’s important that you take a good selfie.

We know we don’t all look amazing for the camera, so don’t worry if you look like Shrek.

We did and it still let us in!

After you take your selfie, you can opt to find friends using the app or you can skip this step for now.

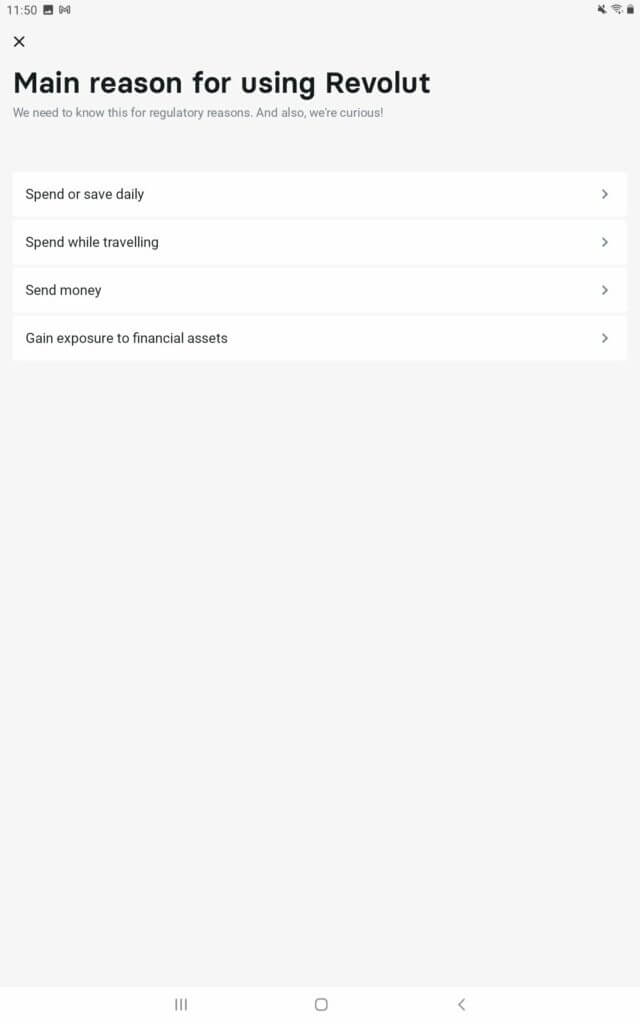

Revolut wants to know your main reason for using the app.

As far as we can tell, this had no impact on our verification experience, but be truthful just in case.

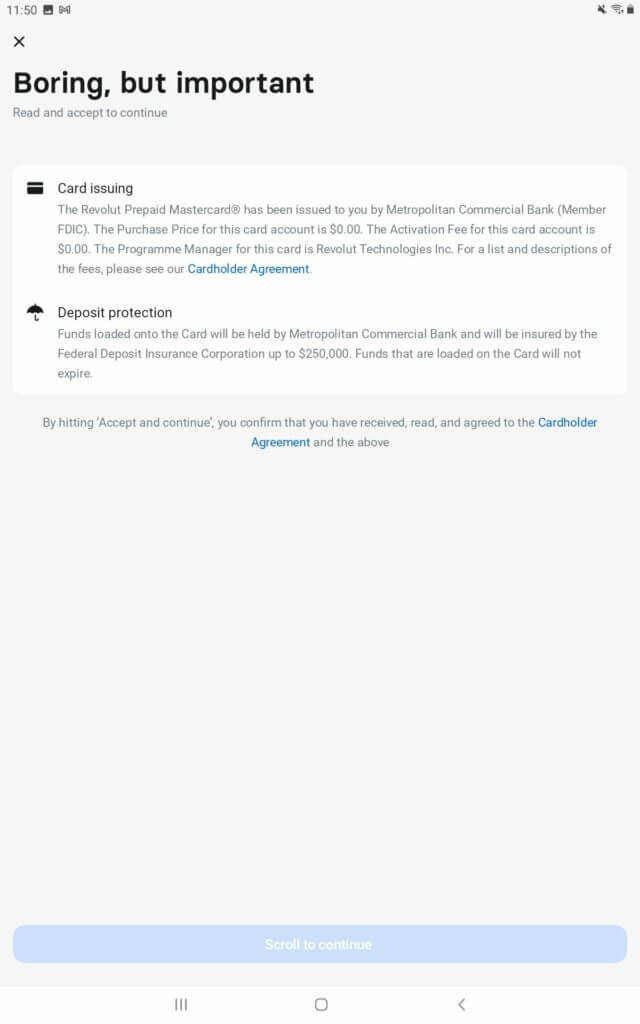

You’ll then need to read 2 agreements and hit continue.

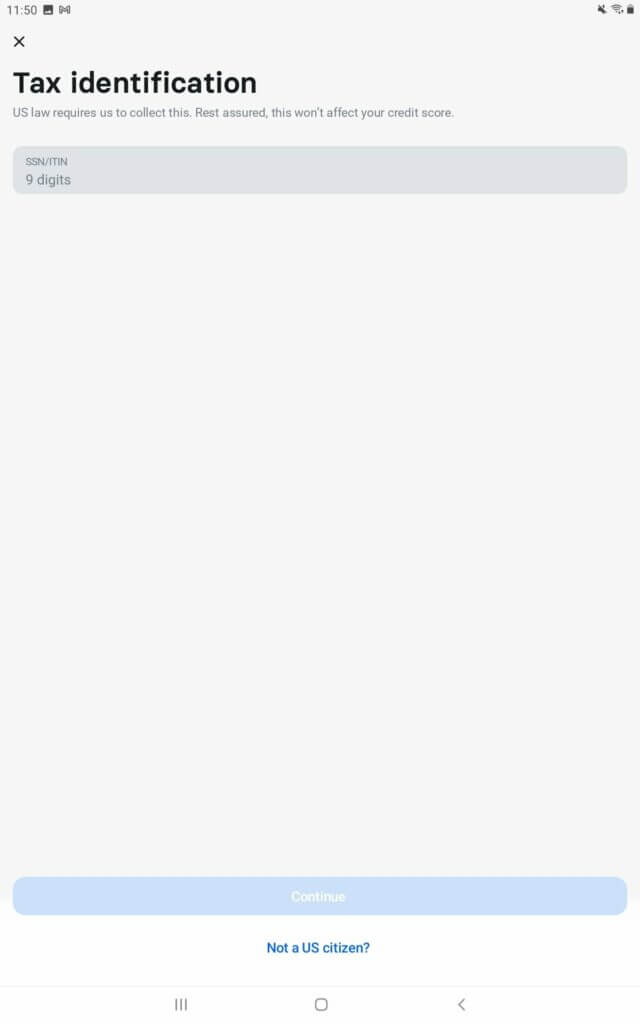

Depending in which country you’re registering from, you’ll need to input your tax identification number next.

In Europe, this is often your government ID number, but some countries also have dedicated tax numbers.

Make sure that you get this correct.

Now we come to the fun part – sending pics of your documents.

Depending on your location, you will need various documents.

Select each document and take a clear photo of it using the app.

Once you’ve taken all the pictures requested, your profile will be sent off for review.

This process can take up to an hour, but in our experience, it was a little quicker, taking around 20 minutes.

That’s it!

You can retake this step as many times as needed to pass verification.

Remember, be honest and take the best pictures possible.

You’ll make the verification team’s life easier, and you’ll get verified faster.

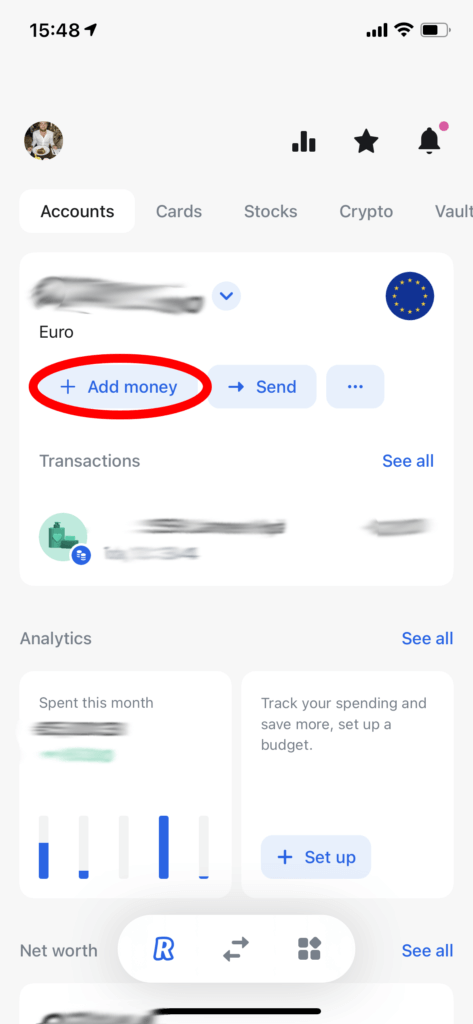

Step 2 – Depositing

Once your account is fully verified and ready to go, you can move on to step 3 – funding your account.

You can do this in a few ways, and we’ll walk you through all of them carefully.

To begin with, head to your fiat account and click, “add money”.

You will then be presented with a few choices for your deposit method.

You can pick any of the following:

- Bank transfer

- Card

- Apple/Google Pay

If you opt for a bank transfer, you’ll be given your fiat account details.

You use these to make a bank transfer from your current bank just as you would any other transaction.

Revolut uses a speedy settlement system, so as soon as your bank goes to move the funds, they’ll be available in your Revolut account.

This is often an instant process, but some banks might take longer to make the transaction for you.

If you opt for a card deposit, you’ll be pleased to know that there’s no fee involved and it’s instant.

Simply pop in your card details and the amount you wish to deposit.

Complete any 3D verification that pops up and the funds will be in your account momentarily.

If you wish to use Apple/Google Pay, you can select that option and double tap the pay button for it to complete.

Congratulations, you’ve just deposited in your Revolut account!

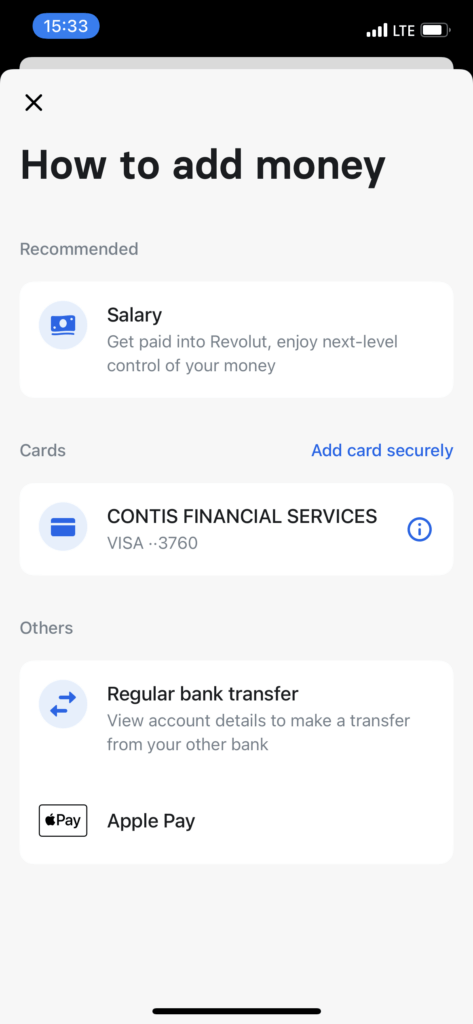

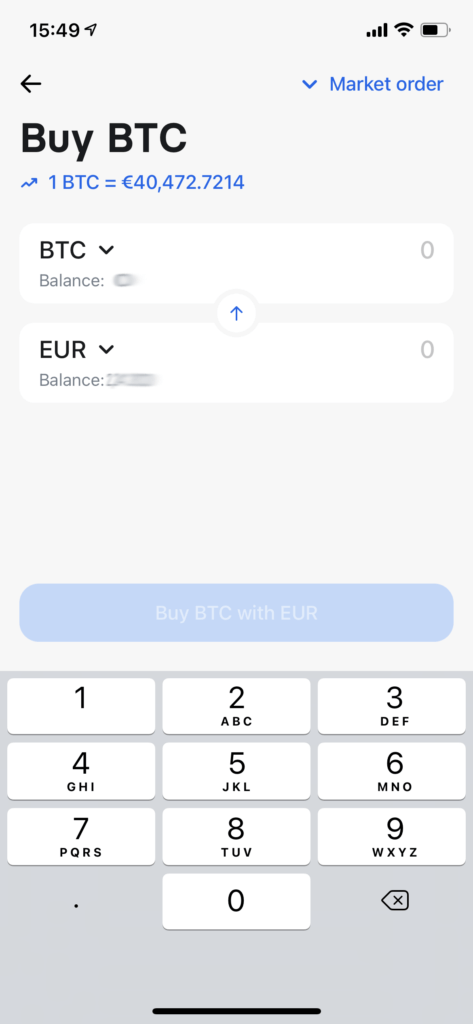

Step 3 – Buying crypto

Now you’ve got money in your Revolut account, it’s time to buy some crypto.

In the menu click on Crypto and then on “invest”.

You can pick from one of the top moving cryptos a bit further down that page, or you can search using the top search bar.

Tap on the crypto you want to buy and press on buy.

You can either input how many coins or tokens you wish to buy, or type in the amount you wish to buy using the fiat option on the bottom half of the trade screen.

Once you’re ready, you can hit buy.

Congratulations, you just bought crypto with Revolut!

Sending cryptocurrency to your external wallet

When you buy crypto, you’re trained to move it to your own wallet.

After all, not your keys, not your crypto.

Exchanges are risky places and get hacked all the time, so storing your crypto there long-term isn’t wise.

Unfortunately, Revolut currently does not let you withdraw your crypto from the platform.

You can do this if you live in the UK, but this is currently the only region in which you can withdraw your crypto from.

Now you might be thinking, ohh it’s a contract for difference (CFD) then.

But, you’d be mistaken – it’s actually crypto.

When you buy crypto at Revolut, Revolut actually buys crypto and stores it in its own wallet.

All funds are pooled together with other users, but Revolut updates its own internal ledger to reflect what you own and its value.

Yes, that does sound rather risky and dodgy.

But, given that Revolut is a bank and operates as a bank, it’s not completely bad.

If you’re new to crypto or just want some crypto exposure in your investment portfolio, it’s a good halfway house

Revolut is working on adding in a feature that allows you to withdraw your crypto from anywhere in the world, but it’s a while off yet.

Banks can prevent purchases of cryptocurrency

There are a lot of banks out there that prevent you from being about to buy cryptocurrency.

This happens even in countries that do not have banking bans on crypto.

But, Revolut offers a rather unique solution to this problem.

Banks allow deposits to Revolut as it’s a financial institution.

You can then either buy crypto through Revolut, or you can opt to use your Revolt account to make deposits at other crypto exchanges.

This is a fantastic way to circumvent any tight restrictions that your bank may have imposed on you, especially when you consider that it’s free to deposit at Revolut.

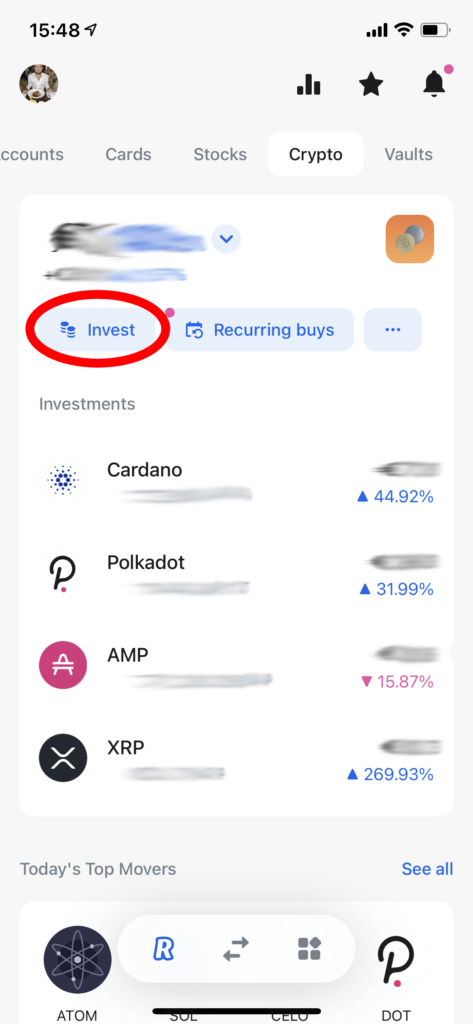

How to sell cryptocurrency at Revolut?

If you’re looking for an exchange to sell your cryptocurrency at, then Revolut is going to let you down once again.

You cannot currently deposit crypto at Revolut, meaning you can only sell crypto at Revolut that you bought on the platform.

This relates back to the fact that all crypto is held in a single wallet, rather than segregated wallets for every user.

If you bought crypto on Revolut and wish to sell it, then you are able to do so.

You can sell crypto at Revolut by going into your crypto asset and clicking on sell.

Input the amount you wish to sell and confirm the sale.

The money will be credited to your fiat account balance immediately.

Why is Revolut so popular?

From the outside, Revolut looks like it doesn’t hold much promise, but with more than 15 million users, it’s astonishingly popular.

Now, most of those users are there for the banking service rather than to buy crypto, but people do use it to buy crypto.

The best part about Revolut is that it’s incredibly beginner friendly.

You don’t need any experience or knowledge to buy crypto at Revolut and you feel safe as a new user.

Its banking security is fantastic at picking up fraud, making it 7x better at detecting this than other major banks.

To activate your Revolut account on a new device, you are required to prove your identity with a selfie.

This is brilliant at stopping sim-swap attacks from taking place.

And its these features that make Revolut so popular.

You won’t find pro traders using Revolut, but you will find people that just want quick and easy access to crypto.

If you’re not going to use crypto to its full potential, then Revolut isn’t a bad option for you.

What we mean by this is that if you’re not going to stake or vote on network upgrades, then the added security and help of Revolut makes it appealing.

The good, bad, and ugly at Revolut

Every crypto exchange has good and bad points about it.

For Revolut, it’s mostly stacked up on the positive side.

Its banking grade security means that your crypto is as safe as can be from hackers and malicious people.

If you’re unsure about your ability to keep your crypto safe, Revolut is a fantastic option.

It’s also quick and easy to use, which makes it ideal for people that are on the go or very new to crypto.

But, the fact that you cannot withdraw crypto to your own wallet outside of the UK or deposit crypto is frustrating.

Revolut is trying to work on this issue and enable these features in the future.

The pros of Revolut

Revolut has a lot going for it and it’s a handy crypto exchange to use if you’re in a pinch or are new to crypto.

Revolut tries its hardest to make using the app simple and easy, which is fantastic for beginners.

The security on offer is some of the best around in the crypto world, meaning that you don’t need to worry about your crypto.

If you run into any issues, there is a live support team on hand 24/7 to resolve your issues.

The Cons of Revolut

Despite its positives and attempts to keep crypto traders happy, Revolut does have some drawbacks.

The crux of the issue with Revolut is the fact that you can’t withdraw and deposit crypto.

Once Revolut sorts out this issue, it will become a much more popular crypto trading venue.

Revolut also doesn’t offer any insurance on the money that you store with them in the form of crypto.

This could be dangerous as if someone hacks Revolut’s wallet and funds get stolen, you won’t get anything back.

There are premium account plans that cost up to €14 a month, but this doesn’t get you a break on the high crypto trading fees of 1.5% per turn.

If you’re using a free or plus account, you’re looking at fees of 2.5% per turn, which is an insane amount.

If you are using Revolut to trade crypto, make sure that you factor in these fees.

Is Revolut safe?

Safety is a big part of the crypto world, so it’s natural to want to know whether Revolut is safe or not.

Revolut is licensed as a bank in multiple countries, meaning that there are authorities that you can go to should something happen.

However, as a digital bank, the only way to get hold of Revolut is via the mobile app’s live chat, which requires you to have an account.

If you follow the rules and don’t do anything shady, Revlout are totally fine to use.

But, if you start trying to upload fake documents or make dodgy payments, you could find your account suspended.

We encountered no issues at all when using Revolut for the purpose of this review.

You cannot add any 2-factor authentication (2FA) apps to your Revolut account, which feels scary.

But, you can opt to turn on biometric identification to unlock your account and you can report any suspicious transactions.

Do you pay fees at Revolut?

Revolut has paid accounts, which max out at €14 a month, as well as free accounts.

The paid accounts entitle you to discounts on trading fees and other perks such as airport lounges, a higher ATM cash withdrawal limit and more.

But, the trading fees are so high that even if you’re paying €14 a month, you’re still looking at some insanely high fees.

For free and plus users, you’re going to pay 2.5% per turn.

That puts the fee for a buy and sell at 5%, which is incredibly high.

Premium and metal plan users get discounted fees of 1.5% per turn.

That’s a total of 3% for a buy and sell, which again, is shockingly high.

Now, Revolut isn’t really designed to be a crypto trading app, it’s a bank that has crypto trading.

The fees for stocks and commodities are significantly lower, so hopefully in time Revolut will adjust its fees.

Revolut buys crypto from exchanges, which obviously have their own fees.

They then throw in their own fees on top to ensure they make a profit from your trade.

It’s unknown whether Revolut is also staking cryptocurrencies or providing liquidity in order to earn additional passive income with your coins and tokens.

Can you trade with leverage at Revolut?

Revolut does not currently offer leverage trading on any of its products.

Its crypto and stock trading platform is aimed at newbies to the world of trading.

This means that you won’t find advanced trading features like this available at Revolut.

You will also find a lack of advanced charting tools, with simple price over time graphs available on a few preset scales.

Is Revolut’s customer support up to scratch?

If you get into difficulty, it’s nice to have a helping hand to turn to.

Fortunately, Revolut has a solid support crew and they’re available in multiple languages.

You’ll automatically be connected to an agent that speaks the language that your app is set to, or English if your language is not supported.

The support team are available through live chat 24/7 and are helpful.

Queues can build up and you can end up waiting a few hours for support.

Paid accounts get priority support, which helps during times of high chat volume.

There’s also a detailed FAQ section that has answers to a lot of questions.

So, if the support queue is long, you might be better off starting out with the FAQ section.

Is Revolut legal?

Revolut complies with banking laws and e-money regulations all around the globe.

This means that it’s completely legal if you can download the app from your local app store.

If you must download an APK or side load the app, then you are probably in a region that Revolut doesn’t support.

Funds stored in your Revolut account are secured by the Deposit Guarantee Scheme, up to a value of €100,000.

Your crypto, on the other hand, is not secured or guaranteed.

Are profits from Revolut taxed?

Crypto taxation is a hot topic at the moment, and it’s a space that’s constantly evolving and changing.

For the most part, your crypto profits will be taxed at standard capital gains rates.

The upshot of this is that if you make a loss, you can claim this back.

Certain countries will allow you to reduce your crypto tax bill by holding your crypto for more than a year.

Other countries that don’t have capital gains tax laws will often not require you to pay tax.

Revolut is a good exchange for beginners

If you’re new to the crypto trading world, then you will want a simple and easy way to use a crypto exchange.

Revolut is perfect for this, and it has the added benefit that it doubles up as a bank account.

You can download trading reports quickly for tax time, and the app is incredibly slick.

New features and coins are being added all the time, so there’s always something new to check out.

However, if you’re a bit more of an advanced trader or are looking to use your crypto, then Revolut is not quite up to the task.

You can only withdraw crypto from Revolut if you’re in the UK and you cannot deposit or stake from Revolut.

That being said, Revolut is a good experience and is great if you just want to get quick and easy exposure to crypto markets.

The fees are incredibly high, even for users on paid plans.

A discount of 1% per turn is applied if you have a paid account, but unless you’re trading large volumes, this isn’t a massive saving.

There’s no other way to reduce trading fees and there’s no rewards for having large trade volume with Revolut.

FAQ

What currencies can I use at Revolut?

You can use a wide range of fiat currencies at Revolut.

As it expands into new markets, it adds more supported fiat currencies.

For the time being, you can currently use the following fiat currencies:

- AED

- AUD

- BGN

- CAD

- CHF

- CZK

- DKK

- EUR

- GBP

- HKD

- HRK

- HUF

- ILS

- ISK

- JPY

- MAD

- MXN

- NOK

- NZD

- PLN

- QAR

- RON

- RSD

- RUB

- SAR

- SEK

- SGD

- THB

- TRY

- USD

- ZAR

Is Revolut available in my country?

Revolut is a compliant banking application that has a crypto trading feature.

As a result, Revolut isn’t available everywhere in the world.

For now, Revolut is available throughout Europe.

You can also access Revolut from the following countries outside of Europe:

- Bonaire

- USA

- Australia

- Japan

- Singapore

Revolut is currently in the process of finalizing its banking permits in the following countries:

- Brazil

- Canada

- UAE

- Hong Kong

- New Zealand

People from these countries will be able to use Revolut in the coming months.

Countries where Revolut operates as a bank

Revolut currently operates in 28 countries under its Lithuania banking license. They include:

1st wave – March 2021

- Lithuania

- Bulgaria

- Poland

- Croatia

- Estonia

- Cyprus

- Latvia

- Greece

- Romania

- Malta

- Slovenia

- Slovakia

2nd wave – October 2021

- Hungary

- Czech Republic

- Austria

3rd wave – December 2021

- Portugal

- Italy

- France

4th wave – January 2021

- Denmark

- Belgium

- Finland

- Germany

- Iceland

- Luxembourg

- Lichtenstein

- Sweden

- Spain

- Netherlands

Will Revolut list more cryptos?

Revolut has a fairly average range of cryptocurrencies, with a massive focus on DeFi coins for some reason.

Revolut makes a considerable amount of its revenue from crypto trading, so it’s in Revolut’s best interest to add new cryptos to its platform.

Of course, it requires its 3rd party exchanges to support the various cryptos that it’s looking to add and there must be demand for the coins in question.

Revolut does add new cryptos from time to time, but there can be lengthy gaps in between listings of new coins.